inheritance tax malaysia

Unlike capital gains tax where certain assets for example cars are treated as exempt there is no general concept of exempt assets for IHT purposes. Corporate income tax CIT due dates.

Question Of Inheritance Tax Resurfaces In Malaysia The Edge Markets

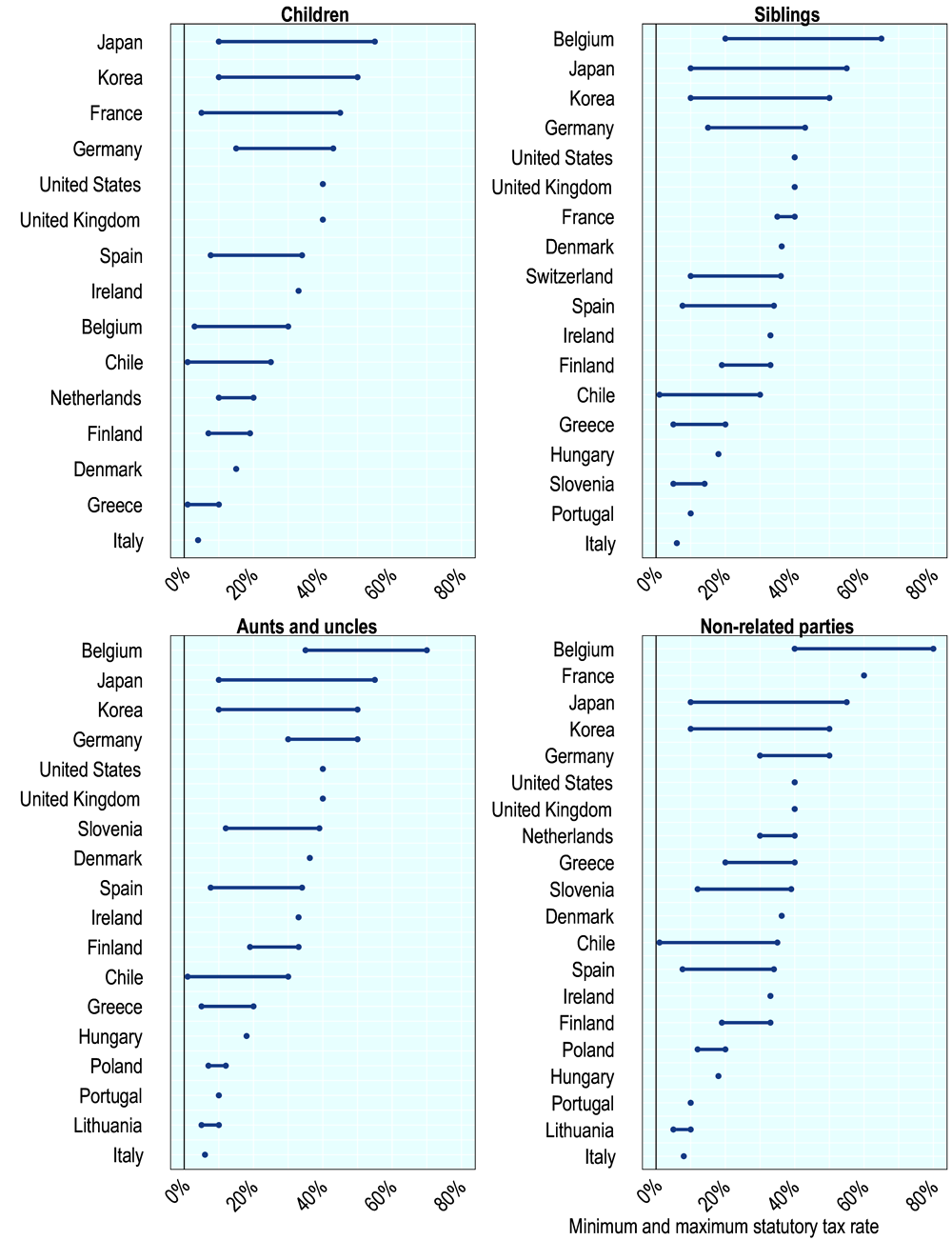

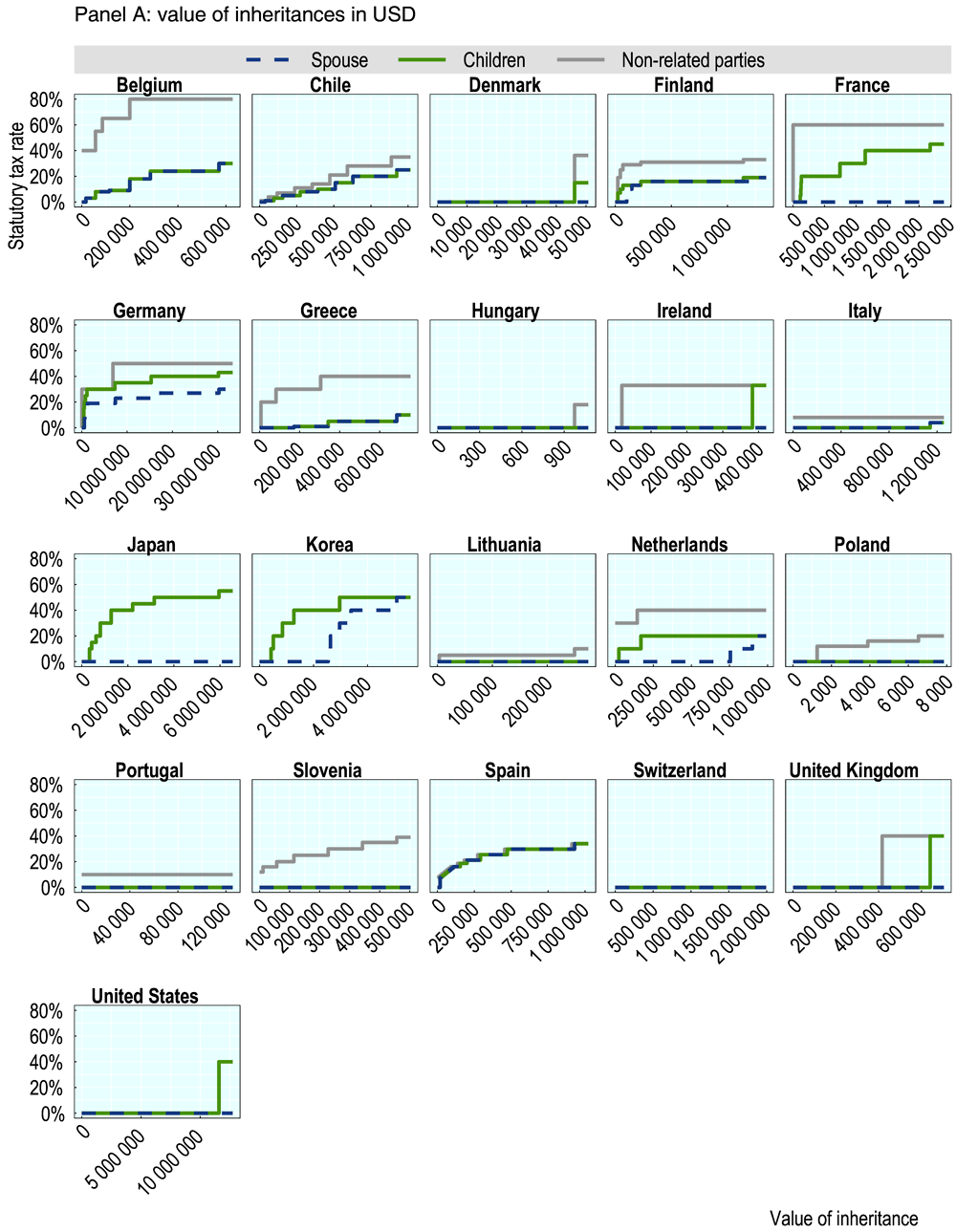

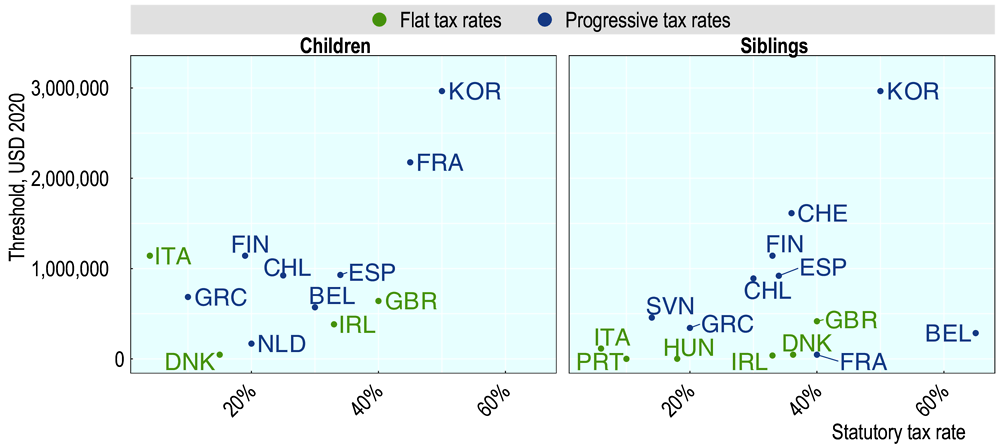

Inheritance and gift tax rates.

. The remainder of the tax reference indicates the employer. Where payments of income are distributed to beneficiaries no inheritance tax is payable because the beneficiaries will be liable for income tax instead. Spanish gift and inheritance tax is levied on goods and rights acquired by Spanish tax residents by inheritance legacy or other type of succession or by donation or other inter vivos legal transfers with no charge.

See wwwirsgov for qualifications. The tax reference number consists of three numbers then several numbers letters or a combination of both. Valid for an original.

Taxation and what inheritance laws apply to foreigners leaving property in Puerto Rico. A Power of Attorney may be required for some Tax Audit Notice Services. Important Terms Conditions and Limitations apply.

See Tax Identity Shield Terms Conditions and Limitations for complete details. However certain assets are regarded as excluded property and are outside the scope of IHT. An example of excluded property is a non-UK asset owned by non-domiciled individual.

An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Net wealthworth tax rates. Capital gains tax CGT rates.

Value-added tax VAT rates. Details of other assets which are regarded as. Spanish gift and inheritance tax is also levied on goods and rights acquired by Spanish non-residents in the manners stated above whatever their nature which.

Tax Audit Notice Services include tax advice only. What restrictions there are and whether making a will is advisable. Corporate income tax CIT rates.

Personal income tax PIT rates. The initial three digits of the tax reference number indicate the tax office dealing with that particular employer. Consult your own attorney for legal advice.

The ten-year charge also known as the periodic charge is payable where the trust contains relevant property where the value is over the 325000 inheritance tax threshold known as the nil-rate band. Petroleum income tax. Employees can also provide their National Insurance number if they need to contact.

The Global Property Guide looks at inheritance from two angles. Personal income tax PIT due dates. Withholding tax WHT rates.

Puerto Rico levies estate and gift taxes on the net taxable value. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. No other taxes are imposed on income from petroleum operations.

INHERITANCE TAX How high is income tax on residents in Puerto Rico.

What Happened To The Expected Year End Estate Tax Changes

Cover Story Will We See New Taxes On Inheritance And Capital Gains The Edge Markets

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Php Taxes Updated Asean Business News

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Common Questions On Property Inheritance In Malaysia

U S Estate Tax For Canadians Manulife Investment Management

Irb Ceo Govt Should Consider Introducing Capital Gains Tax The Edge Markets

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Investors Must Beware Of High Korean Inheritance Tax Asia Times

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

World Bank Says Malaysia Has Plenty Of Scope To Tax Capital Gains Or Inheritance Even As Politicians Say The Contrary Malay Mail

Oecd Better Policies For Better Lives On Twitter The Distribution Of Wealth Is Highly Unequal Across Households On Average Across Oecd Countries 5 2 Of The Total Wealth Is Held By

Number Of Applications In Estate Distribution Section Jkptg In Malaysia Download Table

No comments for "inheritance tax malaysia"

Post a Comment